Dear Reader,

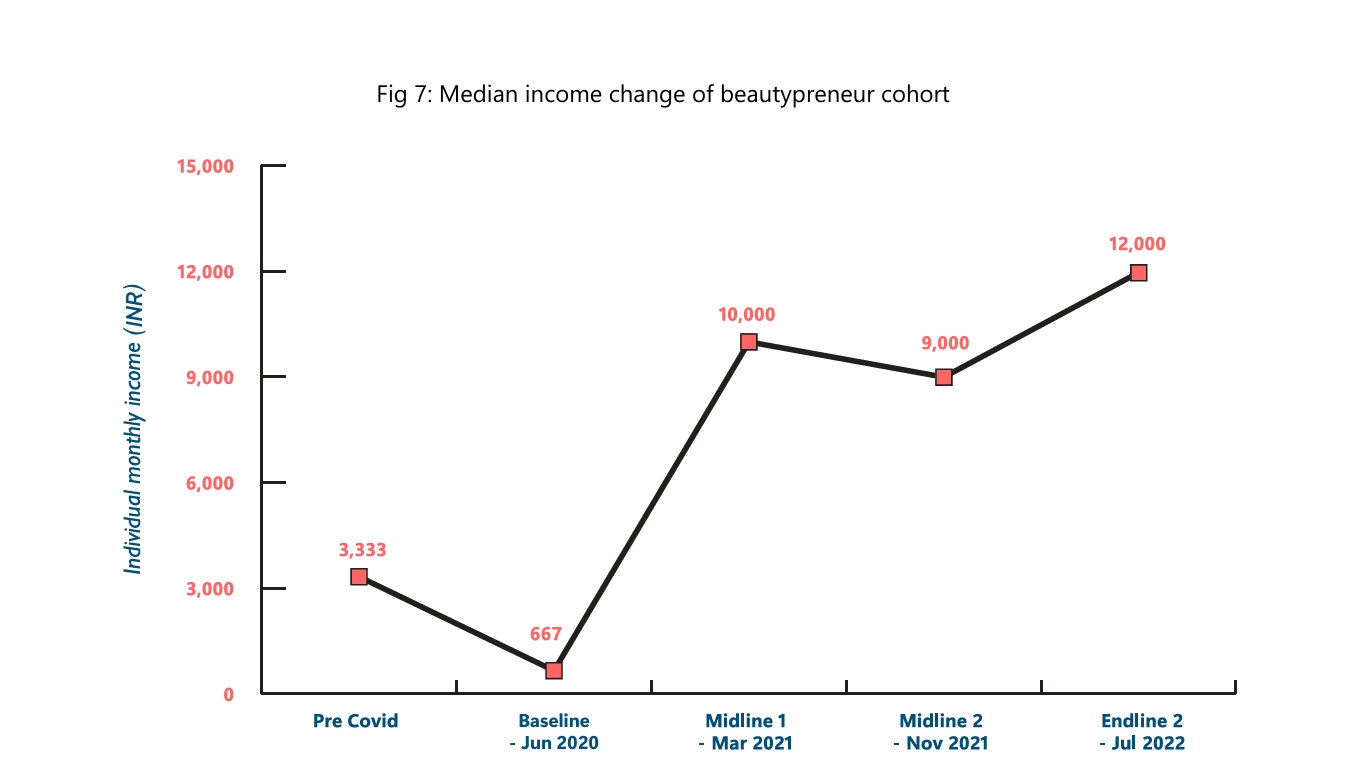

The years of COVID-19 had a severe impact on the entire country, especially more vulnerable groups like informal workers and micro-entrepreneurs — bringing their businesses and lives to a standstill. The REVIVE Alliance was formed in August 2020 by Samhita Social Ventures and Collective Good Foundation (Samhita-CGF) to support these communities, and enable them to safeguard their livelihoods during those testing times.

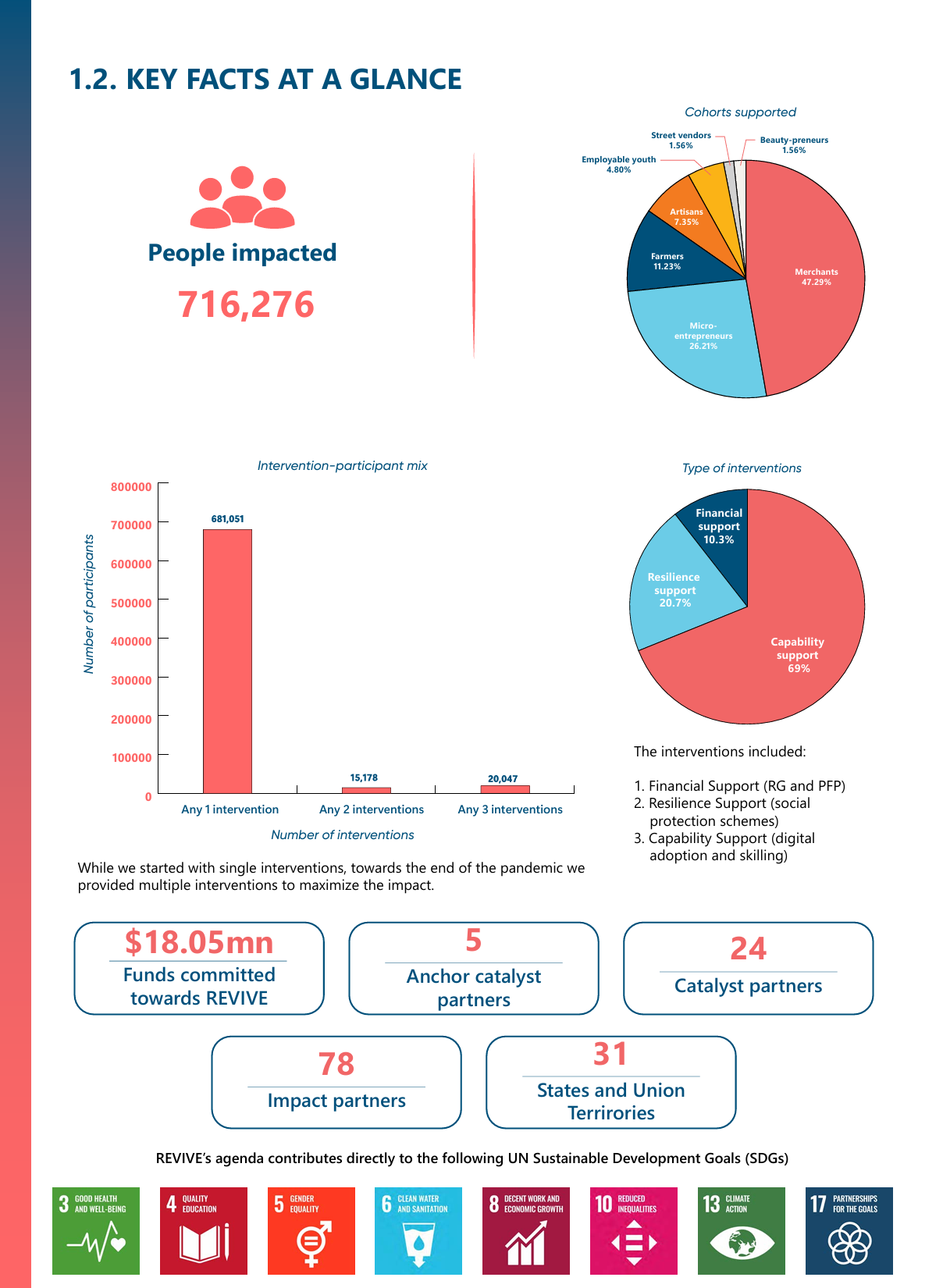

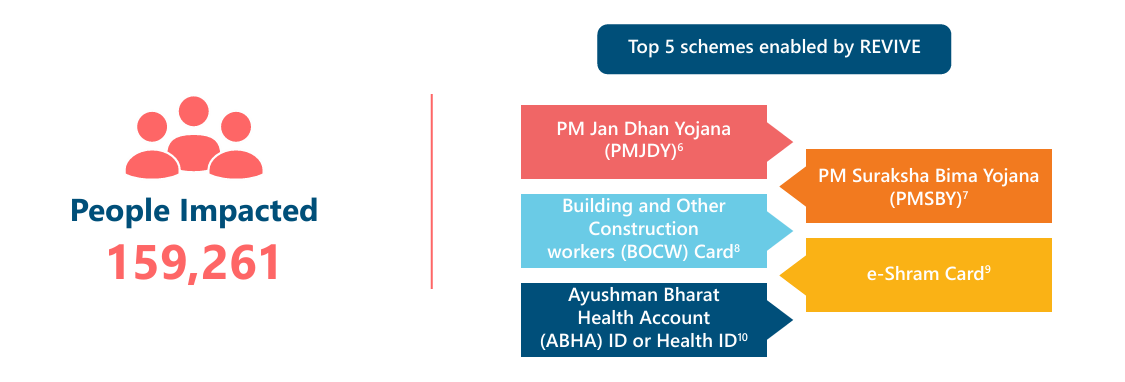

Today, REVIVE, which lasted from August 2020 to September 2023, has become an USD 18.05 million multi-intervention and multi-stakeholder (private, public, philanthropic) platform, serving 70+ cohorts. To get here, we collaborated with 5 anchor catalyst partners, 24 catalyst partners and 78 impact partners to reach 716,276 micro-entrepreneurs and workers across 31 states and union territories in India, with an emphasis on women. Through REVIVE, we aimed to provide holistic support to participants, providing a range of interventions including finance, social protection and capability building support.

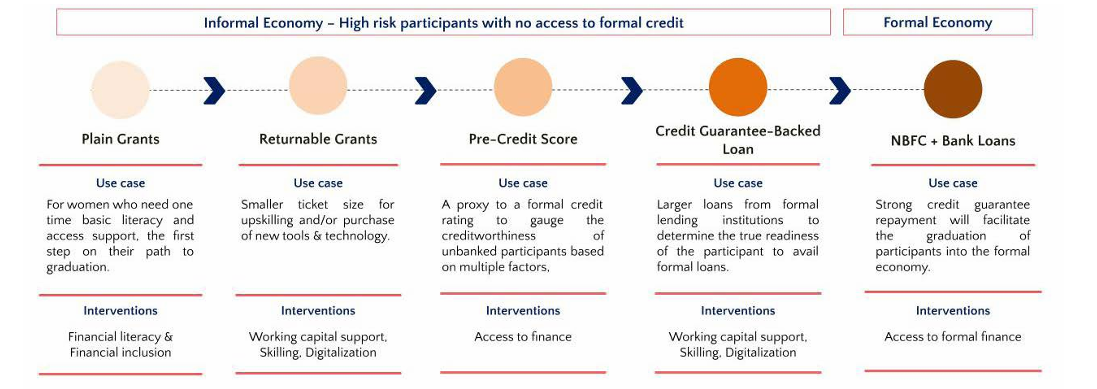

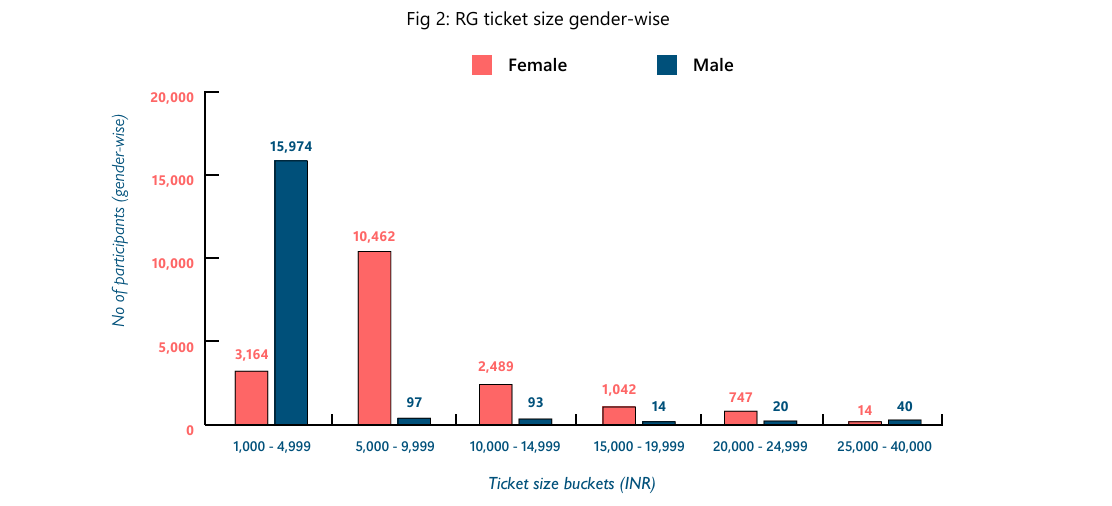

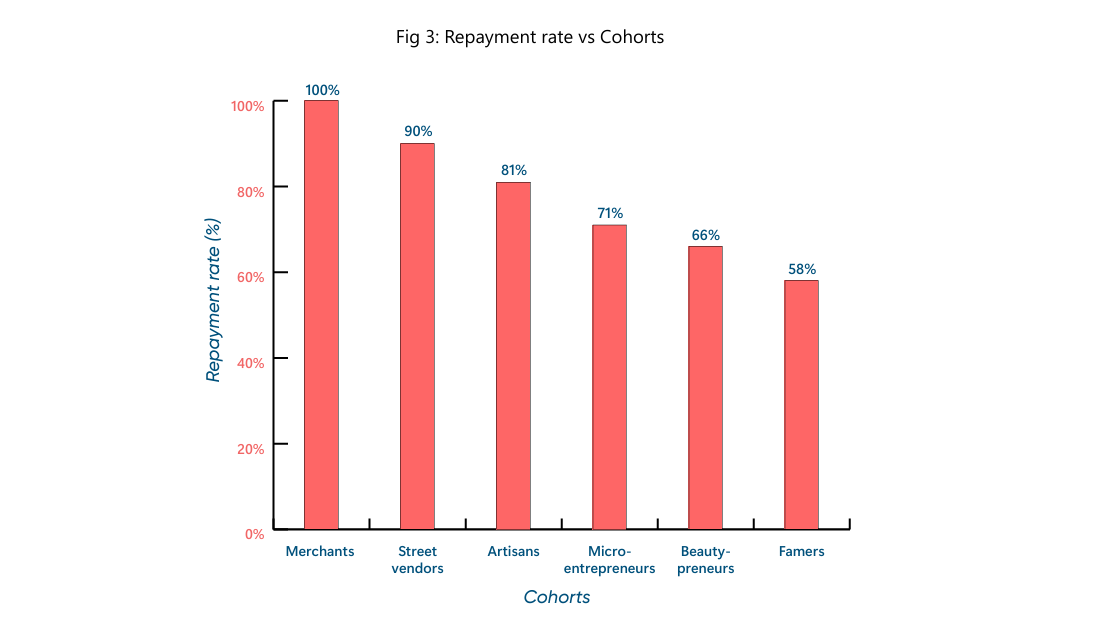

REVIVE introduced a novel financing instrument, Returnable Grants, as a sustainable way to work with partners and achieve a multiplier effect in terms of number of members in a community impacted. This report documents the achievements and learnings from REVIVE and Returnable Grants as we set out to reimagine how we support the improvement of livelihoods of low-income communities going forward. The report provides impact assessment details for the various interventions, especially the Returnable Grants. The findings thus highlight our learnings from the journey so far, and how we all can collectively use these insights to create impact at scale.

The success of REVIVE provides us a great platform to continue to develop and perfect our blended finance continuum approach, especially as we launch various credit guarantee schemes in partnership with nodal government agencies and funders. We now envisage a transition from an alliance with a set of partners to an open network, dedicated to increasing incomes of 10 million participants over the next 6 years.

We thank every organization and individual who has been a part of this journey so far, and we look forward to reaching new heights with every one of you.

With regards,

REVIVE Alliance